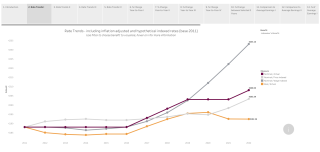

Social welfare rates in Ireland 2011-2022

The Parliamentary Budget Office (PBO) published an analysis of social welfare rate changes 2011-2022 in December 2021. The report looks at core social welfare rates over time, and rate changes compared to both inflation and wage changes. The PBO analysis shows that flat increases in social welfare payments, such as the €5 increase to be applied to core benefits in 2022, result in disproportionate percentage changes and do not systematically account for price (or wage) inflation in a consistent manner.

Cost of living

The report notes that the core Consumer Price Index used in the analysis may be underestimating the real cost of living increases faced by many households at present. Energy and fuel costs, which disproportionately impact those in the lower income deciles and rural areas, are driving inflation at present but housing costs are also a key driver. Specifically, those living in self-funded private rented accommodation are facing recent cost of living increases beyond many owner-occupiers and those in State-supported accommodation.

Jobseeker’s Benefit

Jobseeker’s Benefit will have increased 10.6% in nominal terms between 2011 and 2022, but the real increase is substantially less over that period at 2.3% - accounting for inflation and the 2022 inflation forecast. Following no increases between 2011 and 2016, Jobseeker’s Benefit increased from €188 to €203 between 2017 and 2019 and following two years of no increases to 2021, will increase to €208 in 2022. However, in the absence of increases in many years over the period, the real rate in 2022 will be €192.36 (2011 base). For the rate to stay in line with wage growth over the period and maintain the 2011 rate, the rate in 2022 would need to be €233.10. Wage growth has accelerated significantly more than price inflation, and the nominal increases in Jobseeker’s Benefit.

Jobseeker’s Benefit will increase by 2.5% in 2022. As the rate of inflation is forecast to be 2.5% in 2022, there will be no change in the real rate for recipients. The real rate will actually decrease overall in 2021 as the rate is unchanged but inflation, so far, is at 1.9%. The rate of Jobseeker’s Benefit is substantially below the rate required to keep pace with growth in wages - wage growth was 3.4% in 2019, 4.7% in 2020, 4.8% so far in 2021 and is forecast to be 4.9% in 2022.

Jobseeker’s Benefit kept pace with 27% of average earnings from 2011 - 2015, with little earnings growth over this period. Although there were rate increases from 2016 - 2019, average earnings increases were larger and the absence of rate increases between 2019 - 2021 has widened the gap. Benefit rates have been substantially lower than 30% of average earnings over the period. Using 27%, 27.5% and 30% of average earnings as potential benchmarks to maintain living standards at a reasonable level and keep poverty rates in check, Jobseeker’s Benefit rates have only reached this threshold between 2011 and 2014 when compared to 27% of average weekly earnings. By 2022, based on an earnings growth forecast of 4.9%, Jobseeker’s Benefit will be 86% of 27% average earnings, 84% of 27.5% average earnings and 77% of 30% average earnings. The decline has been most evident since 2019, when earnings growth accelerated.

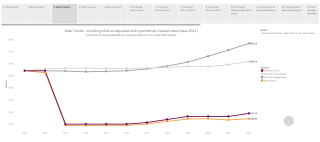

Jobseeker's Allowance Under 25

Following recession expenditure cuts, Jobseeker’s Allowance for those under 25 (and more recently defined as those under 25 not living independently) was reduced from €188 to €100 in 2013. A number of small increases since 2017, including €5 for next year, will see the rate at €117.70 in 2022. However, the real rate in 2022 will be €108.85 (2011 base). For Jobseeker’s Allowance rates for those under 25 to stay in line with the 2011 rate and based on inflation, the rate in 2022 would need to be €203.29. To stay in line with wage growth, the rate in 2022 would need to be €233.10.

Jobseeker’s Allowance for those under 25 not living independently will rise 4.4% in 2022, which is significantly above the annual rate of inflation, forecast to be 2.5%, leading to a potential real rise of 1.9%, albeit still below the rate of wage growth forecast in 2022 (4.9%). However, this is in the context of a dramatic decrease in the rate in 2013 - a fall of circa 47%. Rate increases since then have only fractionally offset that decrease, although staying at or above price inflation in most years since.

Jobseeker’s Allowance for those under 25 will have decreased 37.4% in nominal terms between 2011 and 2022, but the real decrease is even larger over that period at 42.1% - accounting for inflation and the 2022 inflation forecast. The percentage change for Jobseeker’s Allowance for those under 25 is actually larger in 2022 than for other core benefits as the flat €5 increase has also been applied – an example of the disproportionate effect of flat nominal increases.

Social welfare rates not keeping pace with wage growth or recent inflation increases

Overall the report finds that social welfare rates have, in general, kept pace with inflation over the past decade. However, recent increases in inflation and forecasts for next year may result in a drop in the purchasing power for welfare recipients. The PBO also note that current broad inflation estimates may also be underestimating the cost of living increases for sub-sections of the population, in particular those in self-funded private rented accommodation.

Given recent accelerating wage growth, welfare rate increases are substantially behind wage growth at present. This may result in increased inequality across the income spectrum as those at the upper end in employment experience larger proportionate increases in their income than those reliant on welfare payments. This accelerating wage growth may also result in the Contributory State Pension rate falling below the 30% of average earnings threshold for the first time over the period in 2021/2022.

Policy recommendations

Social Justice Ireland has consistently made the case to Government to benchmark core social welfare rates to 27.5 per cent of average weekly earnings. This benchmark of 27.5 per cent of average earnings is so important to the living standards of many in Irish society, and to meeting our own anti-poverty commitments. Social Justice Ireland proposed a €10 increase in core social welfare payments in Budget 2022. This would have set Government on the correct path to benchmark social welfare rates to 27.5 per cent average weekly earnings (€222 per week) over a two-year period, which was the standard set in 2007. The data contained in the PBO report on social welfare rates 2011-2022 highlights the importance of benchmarking minimum rates of social welfare payments to movements in average earnings. Without movement on benchmarking in 2022 vulnerable households will be left further behind.

Download the PBO visualisation of changes in social welfare rates here.

Download the PBO report Changes in Social Welfare Rates 2011-2022 here.

See below our submission to the Oireachtas Committee on Budgetary Oversight on Indexation and the Social Welfare and Taxation System.