€2.4 billion in revenue forgone to fossil fuel subsidies

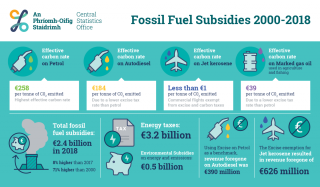

According to the latest data published by the CSO, €2.4 billion was not collected by the Exchequer due to direct subsidies and revenue foregone due to preferential tax treatment supported fossil fuel activities in Ireland in 2018. This represents an increase of 8 per cent on the previous year.

Fossil fuel subsidies can support either production or consumption activities. The Report points to subsidies to fossil fuel producers, which include zero royalty payments on gas and oil production, and which were €91 million in 2018. Subsidies to consumers include the PSO Levy support to electricity generation from peat, which was €66 million in 2018 and revenue foregone due to the excise duty exemption for jet kerosene used for domestic and international commercial aviation, which was €626 million in 2018.

To give that some context – the total expenditure of the Department of Communications, Climate Action and Environment in 2018 was just €552 million[1].

Indirect subsidies such revenue forgone through tax expenditures, accounted for 88 per cent (€2.1 billion) in 2018, while direct subsidies (such as the fuel allowance to low income households) accounted for just 12 per cent (€300 million).

Since the CSO began publishing this data series in 2000, fossil fuel subsides have increased by 71 per cent.

The highest effective carbon rate per tonne of carbon dioxide produced was for petrol, at €258. According to the latest Transport Omnibus[2] private cars accounted for 77.7 per cent of the total of licensed vehicles and 75.3 per cent of the total distance travelled in 2019, meaning private households paying the highest carbon rate. Conversely, jet kerosene used for commercial aviation is exempt from excise and carbon taxes, and the CSO estimate that this equated to €626 million foregone in 2018. The estimated revenue foregone due to the low excise duty rate on autodiesel was €390 million.

Not all fuel subsidies are created equally. Some, such as the fuel allowance (€96 million in 2018) and household electricity allowance (€103 million in 2018) provide crucial supports to low income households and must be maintained until a suitable Just Transition plan has been developed and implemented. Others, such as the exemptions for jet kerosene are harmful to the environment without providing any real societal benefit and, while it is acknowledged that the aviation industry has experienced a negative impact due to the pandemic, a recent report suggests that there are over $140 billion of assets under the management of Irish-based lessors of aircraft and aviation equipment[3].

Social Justice Ireland continues to call for the imposition of a tax on jet kerosene and a comprehensive review of all tax expenditures as part of the annual Budget process. A Just Taxation system is part of our proposed new Social Contract.

[2]Road Traffic Volumes - CSO - Central Statistics Office

[3]Ireland leading the world in the high-flying aviation sector (irishtimes.com)