The gender pensions gap

A new report from the Occupational Pensions Stakeholder Group (OPSG), published last month, provides an excellent analysis of the gender gap in pensions and provides advice on practices to reduce it.

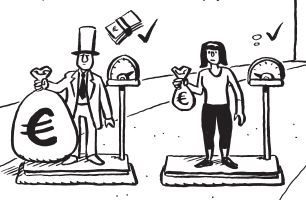

It is well recognised that an unequal situation exists between men and women with respect to their retirement incomes in most developed countries.

The report identifies numerous aspects of employment history that can contribute to this gap, including:

- The number of years in employment - 15% of inactive women are so because of care reasons, while this is only the case for 1.4% of inactive men.

- The intensity of employment - i.e. whether one works part-time or full-time, with women more likely to be in part-time employment.

- The type of employment contract - temporary versus permanent, with varying levels of benefits.

- Employee remuneration.

- The sector in which individuals are employed - i.e. public versus private, patterns of employment in particular sectors etc.

- The statutory, voluntary and conventional rules governing social protection of certain professions, including access to occupational pensions.

In addition, women are still paid less than men for doing jobs of equal or similar value. Other factors, related to the pension system, also have an effect, including:

- How career breaks are compensation and treated for pension purposes.

- Pension redistribution.

- Pension indexation (higher income-higher contribution rates)

- Retirement age differences.

- Differentiated compensation level in occupational pensions schemes

- The existence and extent of survivor’s pensions, as women have on average a higher life expectancy than men and are thus more likely to outlive their partner if they are married.

The report, available here, makes 22 recommendations, among them:

- That the European Commission implement transparency by regular reporting on the gender pension gap in member states.

- That EU member states, establish and preserve solidarity mechanisms that allow for pension credits for career breaks linked to leave for reasons of child care or care to a family member in need for care and assistance.

- That states establish the same obligations and rights about pensions in part-time and fixed-term employment contracts than for open-ended full-time contracts.

- That states encourage social partners to increase the occupational pensions coverage ratios of workers, especially through enhanced social dialogue with professions, employment cohorts and sectors that have predominantly female workforces.

- That social dialogue should include the gender pension gap in the private sector.

The full report is well worth reading, and is available here.

However, it must be acknowledged that so long as a gender pay gap exists, and so long as social expectations dictate that women will do the majority of unpaid work (including caring) and are more likely to take career breaks to care for people in the home, the move that would do most to improve pension equality for women would be the universalising of the state social welfare pension. The current system in Ireland, where benefits received have a strong connectivity to labour market history, has inevitably led to women receiving lower pension payments from the state and being more reliant on the lower level non-contributory pension. Whilst differentials in payments from private pensions exacerbate this, it is the state pension's role to set a floor under which the living standards of the elderly should not fall.

Check out Social Justice Ireland's report on a universal pension for Ireland, published in 2018.