Now is the time to introduce Refundable Tax Credits

Yesterday, Social Justice Ireland published Poverty Focus 2018, a new annual publication that looks at the figures behind poverty in Ireland. This year’s edition of Poverty Focus pays special attention to the working poor.Poverty Focus 2018 highlights the fact that more than 100,000 people in employment in Ireland are at risk of poverty. This is a remarkable statistic and it is important that policymakers recognize and address this problem. What is even more notable is that this number has been rising since 2009. The economic recovery has failed to address the issues of low pay, precarious work and an unfair tax system. Of all those living below the poverty line, people in employment made up 13.3%, contradicting the notion that a job is, by itself, a guaranteed way out of poverty.

If people in employment can’t be guaranteed a life free from poverty then there is something seriously wrong. We have been saying for quite some time now that Ireland’s social contract is broken. This is further proof. In this context, the failure to make tax-credits refundable is totally unacceptable. Implementing this policy would make Ireland’s tax system fairer, address part of the working poor problem, and improve the living standards of a substantial number of people in Ireland.

Introducing Refundable Tax Credits

Everyone with a job receives (at least) two kinds of tax credits: the PAYE tax credit, and the Personal tax credit. These amount to €1,650 each, for a total €3,300. These credits are used to reduce the employed person's tax bill. So if your tax bill as calculated using the different rates and bands amounts to €6,000 per year, you deduct your credits from this bill, for a final liability of €2,700 in the year.

Tax credits are fairer way of achieving a tax reduction than any past or present systems of allowances or reliefs, and mean that (for the most part) any changes to the tax system implemented via tax credits will be felt equally by all.

There is one exception to this: some low income workers do not earn enough to use up their full allocation of tax credits. Consequently they will not benefit from any increases to the PAYE or Personal tax credits. This is because you must earn at least €16,500 per year, or €317 per week, in order to benefit from the full tax credit.

Making tax credits refundable would be a simple solution to this problem. It would mean that the "un-used" part of the tax credit would be “refunded” (essentially paid, at the end of the tax year) to him/her by the Revenue Commissioners. The major advantages of making tax credits refundable lies in addressing the disincentives currently associated with low-paid employment, and in helping to relieve poverty among working people. The main beneficiaries of refundable tax credits would be low-paid employees (both full-time and part-time). It is important to remember that this is not a social welfare payment. The recipients of this proposal are working people who struggle to find employment that pays them enough to live above the poverty line.

Making tax credits refundable: the benefits

- Would address the problems of low pay and in-work poverty in a straightforward and cost-effective manner.

- No administrative cost to the employer, as the payments would be made directly by Revenue.

- Would incentivise employment over welfare as it would widen the gap between pay and welfare rates.

- Would ensure that all increases to tax credits implemented by government would be felt equally.

- Would be more appropriate for a 21st century system of tax and welfare.

Details of Social Justice Ireland proposal

- Unused portion of the Personal and PAYE tax credit (and only these) would be refunded.

- Eligibility criteria is applied to the relevant tax year.

- Individuals must have unused personal and/or PAYE tax credits (by definition).

- Individuals must have been in paid employment.

- Individuals must be at least 23 years of age.

- Individuals must have earned a minimum annual income from employment of €4,000.

- Individuals must have accrued a minimum of 40 PRSI weeks.

- Individuals must not have earned an annual total income greater than €16,500.

- Married couples must not have earned a combined annual total income greater than €33,000.

- Payments would be made at the end of the tax year.

Cost of implementing the proposal

In 2010 Social Justice Ireland published a detailed study on the subject of refundable tax credits. Entitled Building a Fairer Tax System: The Working Poor and the Cost of Refundable Tax Credits, the study established the cost of making this change would be €140m. The Social Justice Ireland proposal to make tax credits refundable would make Ireland’s tax system fairer, address part of the working poor problem, and improve the living standards of a substantial number of people in Ireland. The following is a summary of the major findings of this study.

Major findings of the study

At the time of the study, it was estimated that:

- Almost 113,300 low income individuals would receive a refund and would see their disposable income increase as a result of the proposal. When children and other adults in the household are taken into account the total number of beneficiaries would be 240,000.

- The majority of the refunds would be worth under €2,400 per annum, or €46 per week, with the most common value being individuals receiving a refund of between €800 to €1,000 per annum, or €15 to €19 per week.

- Considering that the individuals receiving these payments have incomes of less than €16,500 (or €317 per week), such payments are significant to them.

- Almost 40 per cent of refunds would flow to people in low-income working poor households who live below the poverty line.

- A total of 91,056 men, women and children below the poverty threshold would benefit either directly through a payment to themselves or indirectly through a payment to their household from a refundable tax credit.

- Of the 91,056 individuals living below the poverty line that benefit from refunds, most, over 71 per cent receive refunds of more than €10 per week with 32 per cent receiving in excess of €20 per week.

- A total of 148,863 men, women and children above the poverty line would benefit from refundable tax credits either directly through a payment to themselves or indirectly (through a payment to their household. Most of these beneficiaries have income less than €120 per week above the poverty line.

- Some 240,000 individuals overall, all of whom are living in low-income households, would experience an increase in income as a result of the introduction of refundable tax credits.

Once adopted, a system of refundable tax credits as proposed in this study would result in all future changes in tax credits being equally experienced by all employees in Irish society. Such a reform would mark a significant step in the direction of building a fairer taxation system and represent a fairer way for Irish society to allocate its resources.

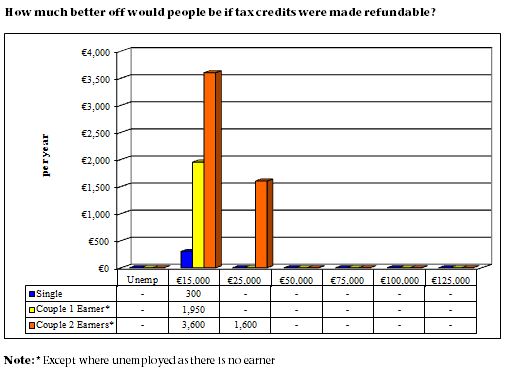

The chart below displays the impacts of the introduction of this policy across various gross income levels. It clearly shows that all of the benefits from introducing this policy would go directly to those on the lowest incomes.

Most people with regular incomes and jobs would not receive any cash refund because their incomes are too high. They would simply benefit from any increase to tax credits via a reduction in their tax bill. Therefore, as the above chart shows, no change is proposed for these people. For other people on low or irregular incomes, the refundable tax credit could be paid via a refund by the Revenue Commissioners at the end of the tax year. Following the introduction of refundable tax credits, all subsequent increases in the level of the tax credit would be of equal value to all employees.

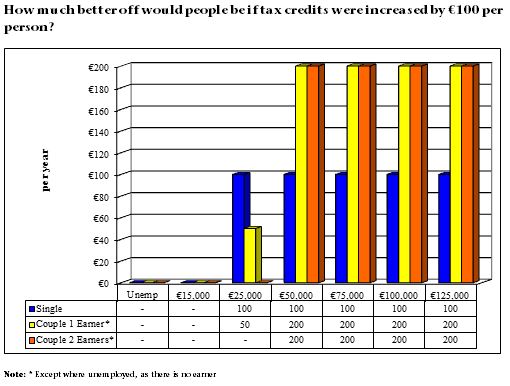

To illustrate the benefits of this approach, the charts below compare the effects of a €100 increase in the personal tax credit before and after the introduction of refundable tax credits. The first shows the effect as the system is currently structured – an increase of €100 in credits, but these are not refundable. It shows that the gains are allocated equally to all categories of earners above €50,000. However, there is no benefit for those workers whose earnings are not in the tax net.

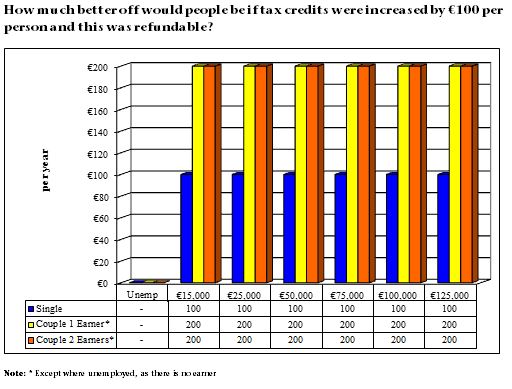

The second chart shows how the benefits of a €100 a year increase in personal tax credits would be distributed under a system of refundable tax credits. This simulation demonstrates the equity attached to using the tax-credit instrument to distribute budgetary taxation changes. The benefit to all categories of income earners (single/couple, one-earner/couple, dual-earners) is the same. Consequently, in relative terms, those earners at the bottom of the distribution do best.