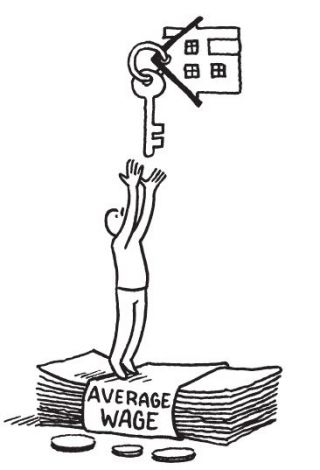

Shared Equity in Unaffordable Housing

In January 2021, the Minister for Housing, Local Government and Heritage published the General Scheme of the Affordable Housing Bill 2020[1] (the General Scheme). Various mechanisms are contained within the terms of the General Scheme to provide affordable housing to purchasers, however many of these are unclear and problematic.

Head 5 of the General Scheme, for example, provides for a situation where a Housing Authority may enter into an agreement with a developer to build housing at a set price and sell that housing a price that is less than the price agreed with the developer. The Housing Authority will then pay the developer the difference between the purchase price and the price agreed. This type of arrangement is currently in operation in respect of some Part V developments and generally results in Local Authorities spending more on the delivery of social and affordable housing by private developers than they would have if they had developed their own lands. The key difference with Head 5, however, is that the opposite is also provided for. So, if the Housing Authority enters into an agreement with a developer to build housing at an affordable price, and the actual sale price is higher than the unit cost agreed, the developer will pay the Housing Authority the difference between the agreed price and the sale price. The General Scheme is itself unsure as to how this provision would apply to sales by the Land Development Agency and the statement that this “…can be dealt with in regulations if necessary” is of little value given the potential powers of the Land Development Agency set out in the 2021 Bill referenced above to acquire large swathes of public lands.

The General Scheme also, in Head 21, provides for the Housing Authority to provide an equity loan to first time buyers for the purchase of newly constructed housing. The equity charge will be subordinated to the purchaser’s mortgage and, in a move away from previous schemes, any subsequent equity release loan the purchaser might take out with their lending institution. In the event of the purchaser wanting to sell their property, they then repay their mortgage and the market value of the equity stake at the time of sale. This scheme targets the same purchasers as the Government’s Help to Buy scheme. A scheme that has been proven to disproportionately benefit higher earners and drive up property prices.

It should be telling that shared equity was proposed by a bank in response to what it called the “slowdown in residential property prices, particularly in the Dublin market” as a result of the Central Bank’s macroprudential rules (O'Sullivan & McGuckin, 2020). While acknowledging that supply-side measures would be the most appropriate way to address affordability, the lack of delivery of these necessary measures leaves “the other option” of demand-side subsidies (p. 1). A recent Spotlight on Shared-equity homeownership considered the various methods of shared equity available in several jurisdictions and concludes that individual-oriented models of shared equity, such as shared equity loans, have the potential to provide greater benefit than community-oriented models, notwithstanding that they face problems with marketability, sustainability and affordability (Gupta, 2020). The paper ultimately proposes a combination of individual- and community-oriented models and reforms to existing offerings.

Affordability for housing under the General Scheme will be assessed, not on the basis of 35 per cent of net household income as was previously the case, but on the purchaser’s inability to access a mortgage from a bank or lending institution for 90 per cent of the purchase price. An equity stake, provided for under Head 21 referenced above, would then be the difference between the purchase price the purchaser can pay using the maximum loan they can obtain from the financial institution (or the lowest price the housing authority agrees the unit can be sold for, whichever is the lowest) and the market value of the property. This acts to effectively circumvent the Central Bank of Ireland’s macroprudential rules, leaving the purchaser with a level of housing debt they cannot objectively afford. In addition, the purchaser of an affordable home must be able to have saved at least 10 per cent of the market price.

As of Q3 2020, almost one in ten of all private dwelling house (PDH) mortgages in arrears were in arrears of more than 10 years, and almost 3 in ten were in arrears for over 5 years. For buy to let mortgages (BTL), those figures are 12 per cent in arrears for more than 10 years and 42 per cent for over 5 years. These households have not yet recovered from the crash of 2008. Government must learn from that experience and develop truly affordable housing, rather than implementing policies that only serve to artificially increase housing costs and facilitate over-borrowing.

Eligibility for affordable housing is stratified by size of household, residence in the administrative area, application date and any other criteria as may be prescribed. This discriminates against new households coming to the area and should be challenged on this basis.

[1] At time of writing, this Bill is being debated