Income Gains and Effective Tax Rates after Budget 2020

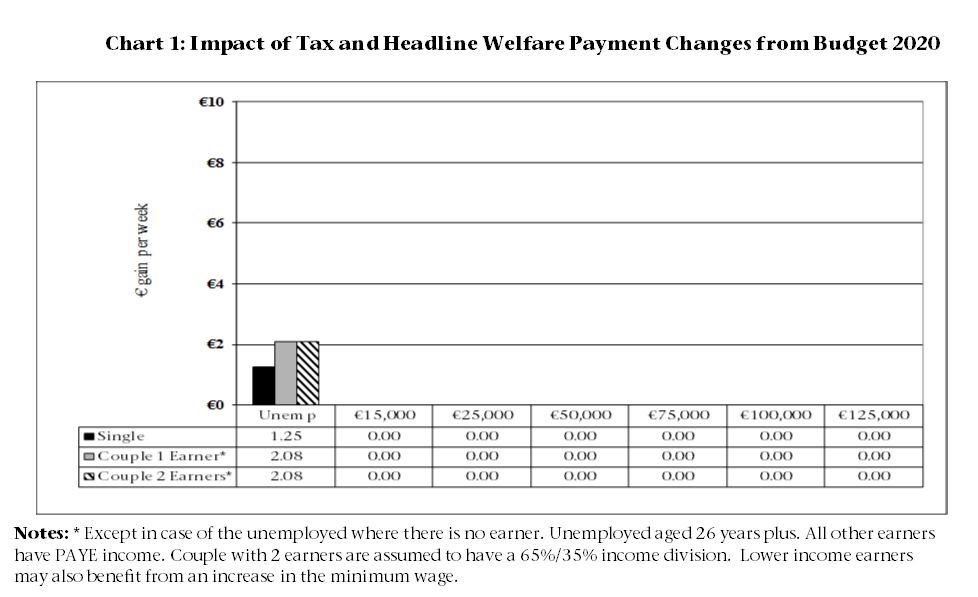

When assessing the change in people’s incomes following any Budget, it is important that tax changes be included as well as changes to basic social welfare payments. In our calculations we have not included any changes to other welfare allowances and secondary benefits as these payments do not flow to all households. Similarly, we have not included changes to other taxes (including indirect taxes and property taxes) as these are also experienced differently by households. Chart 6.1 (page 6) demonstrates that there is little change arising from Budget 2020 announcements on the various household groupings we track annually.

There is no proposed increase in the weekly rate of jobseekers benefit in Budget 2020 and the increase shown in Chart 1 for the unemployed merely reflects the full year effect of Budget 2019’s increase of €5 per week for single people and €8.30 per week for persons with a qualified adult which came into effect from March 2019 together with the increased value of the Christmas Bonus i.e. total increase year on year of €65 for a single person and €108 for a couple.

However, many of those in employment will benefit from pay increases or incremental credits which will not apply to those in receipt of social welfare benefits alone. For example TDs have recently benefited by approx. €1,600 per annum arising from public sector pay restoration and will receive a further €2,113 per annum from October next year, an overall increase of approx. €71 per week gross. Such increases in income benefit those better off while not accruing to those most vulnerable in society.

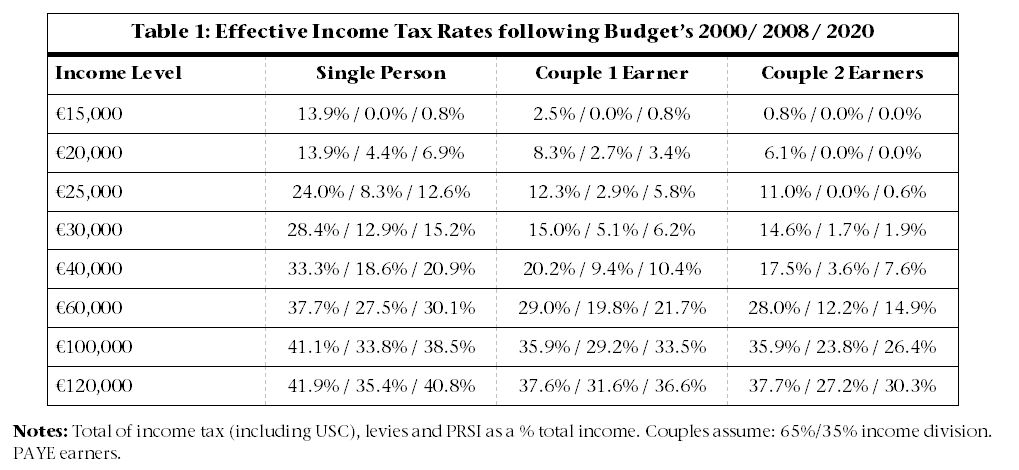

Central to a thorough understanding of income taxation in Ireland are effective tax rates. These rates are calculated by comparing the total amount of income tax a person pays with their pre-tax income. For example, a person earning €50,000 who pays €10,000 in taxation (after all their credits and allowances) will have an effective tax rate of 20 per cent. Calculating the scale of income taxation in this way provides a more accurate reflection of the scale of income taxation faced by earners.

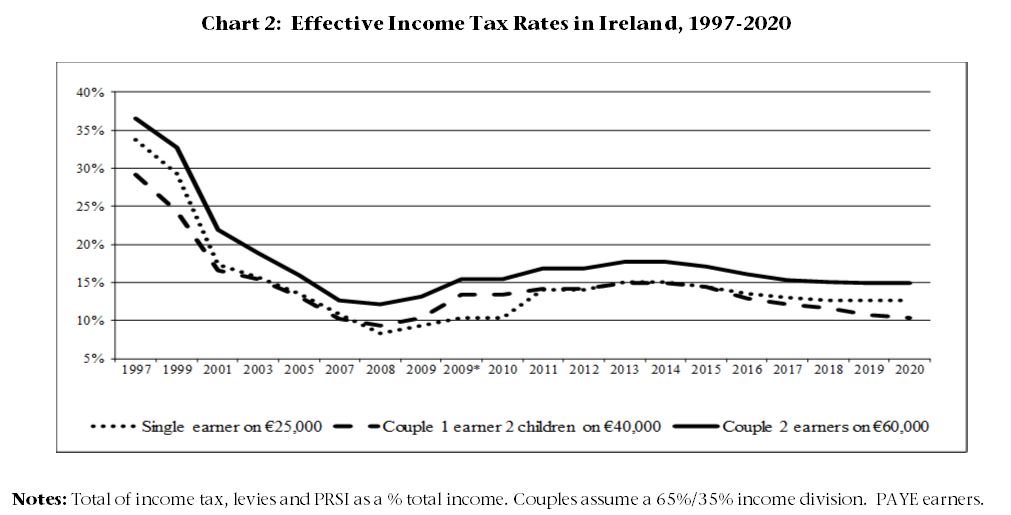

Following Budget 2020 we have calculated effective tax rates for a single person, a single income couple with two children and a couple with two earners. Table 1 presents the results of this analysis. For comparative purposes, it also presents the effective tax rates which existed for people with the same income levels in 2000 and 2008.

In 2020, for a single person with an income of €15,000 the effective tax rate will be 0.8 %, rising to 12.6 % of an income of €25,000 and 40.8 % of an income of €120,000. A single income couple will have an effective tax rate of 0.8 % at an income of €15,000, rising to 5.8 % at an income of €25,000, 21.7 % at an income of €60,000 and 36.6 % at an income of €120,000. In the case of a couple where both are earning and their combined income is €40,000 their effective tax rate is 7.6 %, rising to 30.3 % for combined earnings of €120,000.

As Chat 2, below, shows, despite increases during the recent economic crisis, these effective tax rates have decreased considerably over the past two decades for all earners.