Fairer income tax options are available in Budget 2020

Possible changes to income taxation levels have been highlighted as a potential policy reform in Budget 2020. Social Justice Ireland believes that the best reform to the income taxation system would be to make tax credits refundable. Such a reform would mean that the full value of tax credits goes to everybody who has an earned income. We outline our proposal on this issue here.

Broader reforms to income taxes are not a central priority for Social Justice Ireland either in the forthcoming Budget or in any future plans for taxation policy reform. We believe that any available money should be used to improve Ireland's social services and infrastructure, reduce poverty and social exclusion and target the creation of employment opportunities for those most distant from the labour market – policy priorities highlighted throughout this publication.

However, as discussion and policy considerations often focuses on income taxation reductions we have undertaken a study which examined, from the perspective of fairness, various reform choices. As a minimum, the analysis highlights the distributive impact taxation policy choices can have and the potential policy has to pursue both fair and unfair outcomes.

Last week the Department of Finance's Tax Strategy Group noted that some of Taoiseach Varadkar’s key taxation promises could be “inequitable” and lead to increased benefits for higher earners while middle-income taxpayers lose out. This highlights the importance of evidence-based analysis to illustrates that true effects of taxation policy changes to ensure that such changes are based on projected outcomes that are deemed to be fair, and are not ideologically driven. It is also worrying that the Department of Finance has noted that the Taoiseach’s pledge to raise the threshold at which the higher-rate of income tax (40%) applies to €50,000 would reduce the tax-take by €2.3 billion per year. This is an extraordinary amount of money by which to consider cutting government revenue at a time when public services are stretched and Ireland is suffering from multiple infrastructural deficits in areas as diverse as housing, healthcare and childcare.

In this article, we present a number of possible situations for comparison. In all cases the income tax reduction policy examined would carry a full year cost of between 1.3% and 1.5% of the total income taxation yield (€299m-€342m). As noted above, we believe that any available money should be used to improve Ireland's social services and infrastructure. However the prudence of the scale of our suggested reductions (circa €300m versus €2.3 billion) should be noted and contrasted with suggestions seen elsewhere. Ireland is not currently in a position where it was afford a narrowing of the tax base or a significant reduction in yield.

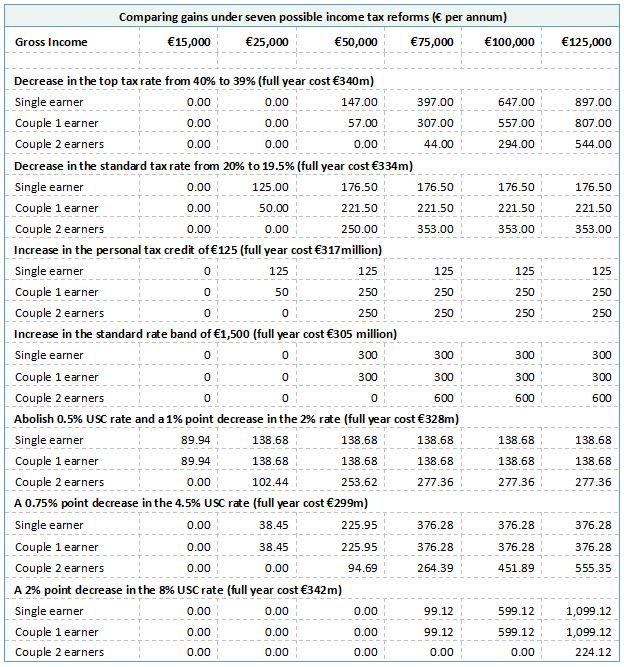

The table below presents our comparisons. In all cases the policy examined would carry a full year cost of between 1.3% and 1.5% of the total income taxation yield (€299m-€342m).

The reforms examined are for changes to the 2019 income taxation system and are:

- a decrease in the top tax rate from 40% to 39%

- a decrease in the standard rate of tax from 20% to 19.5%

- an increase in the personal tax credit of €125 with commensurate increases in couple, widowed parents and the single person child carer credit

- an increase in the standard rate band (20% tax band) of €1,500

- the abolition of the 0.5% USC rate - that applies to income below €12,012 and a 1% point decrease in the 2% USC rate – that applies to income between €12,012 and €19,874

- a 0.75% point decrease in the 4.5% USC rate – that applies to income between €19,874 and €70,044

- a 2% point decrease in the 8% USC rate – that applies to income above €70,044

Although all of the income taxation options have similar costs (1.3%-1.5% of the income taxation yield), they each carry different effects on the income distribution.

Overall, two of the changes would produce a fair outcome:

- increasing the personal tax credit; and

- reducing the 0.5% and 2% USC rates.

The other five changes produce an unfair outcome where the benefits are skewed towards those with higher incomes.